Giving people money to buy houses does not make houses more affordable

A lesson in supply and demand

Last week Kamala Harris announced a plan whereby first-time homebuyers would be given $25,000 in down payment support. House prices have gone through the roof over the last four years, and people are clamoring for relief. The idea is that assisting homebuyers in buying a home will make them more affordable.

What nonsense.

It doesn’t take a genius to see why. If one person is given $25,000 to buy a home, good for them. They will be able to buy a slightly better home than before. If millions are given $25,000 to buy a house, no such luck. Why? Because all that increase in funds will drive up the prices of homes. Not only is this common sense, but it’s something we’ve seen before. For decades the government has subsidized higher education, effectively letting colleges charge what they want and giving out trillions (literally) of dollars worth of subsidized loans to make college more “affordable”. Unsurprisingly, the result is that colleges dramatically increased their tuition.

Not only have we seen that in the market for higher education, but we’ve already seen it in the market for housing. The federal government has enacted many policies that make housing more “affordable”. First, homeowners can deduct interest paid on a primary mortgage from their taxes. Second, the federal government protects mortgages through Fannie Mae and Freddie Mac. No other country in the world does this. This protection leads banks to issue 30-year fixed-rate mortgages. This is a great system for homeowners. If interest rates rise, they are locked into a low rate. If interest rates fall, homeowners can refinance at the lower rates. The problem is that if rates are significantly higher than a recent low for several years, as is currently the case, current homeowners are loathe to sell. Why would they? Millions of households around America have mortgages with interest rates around three percent. Few of those are willing to give up that cushy (and government subsidized) rate and pay more for a new house. The result is the disastrous housing market we see today.

Giving potential homeowners a $25,000 bonus for buying a house will further fuel this raging inferno. It will increase the amount of money buyers have to spend without increasing the supply of homes on the market. The result will be higher prices. A similar thing happened with electric cars. Once the government announced a tax credit, people reported that EV dealers immediately raised their prices. This isn’t because of greed or price gouging or anything like that. It’s simple supply and demand. If demand increases but supply stays constant, then prices will rise.

For those who are still skeptical, what do you think would happen if first-time homebuyers were given $100,000 to buy a home? Or $500,000? The price of homes would explode. No one would ever sell their home for less than the giveaway. Unless you can provide a strong reason for why $100,000 would increase home prices but $25,000 would not, then it’s time to admit that giving away money while keeping supply constant can only result in increased prices.

To be fair to Harris, she also calls for the construction of three million new housing units. The problem is that the president, or federal government, has little control over the housing supply. As I’ve written about endlessly (including here and here), the housing market has a lack of supply because of a labyrinth of restrictions. These restrictions have mostly been put into place by local governments. Almost everyone would agree that three million new housing units is a great idea - as long as none of them are near their property. NIMBYism at its finest.

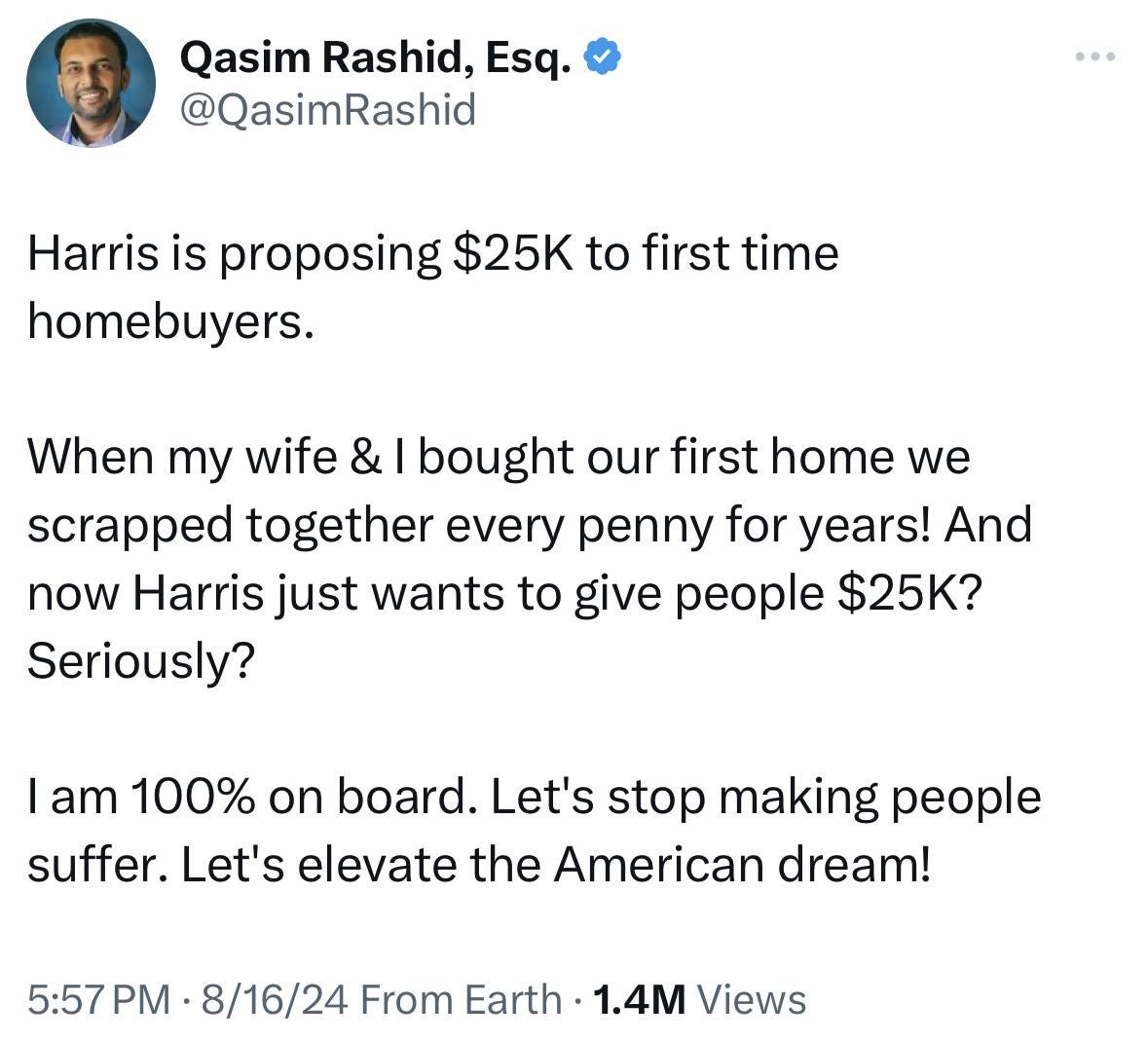

This plan has led to some predictably bad takes, like this tweet that was reposted to Reddit and garnered 79,000 upvotes:

Almost all the comments are positive responses. People are saying things like, “Companies should be prevented from buying up houses” and, “Just because ‘it sucked for me’ doesn’t mean it should suck for other people.” There are two problems with this attitude. First, picking winners, in this case first-time homebuyers, also means picking losers. Past homeowners who are currently renting would be left out in the cold. They would be at a large disadvantage knowing that many others in the market for a house are being given $25,000. Second, having a current homeowner act like it is charitable of them to support this policy is disingenuous. This person stands to gain from the program, as when they want to sell their home they can get a higher price. I own a house in Connecticut. Of course I would benefit from a program that gave any out-of-state person $100,000 to buy a house here. That raises the price I can sell my house for. Want to stop the “suffering” in the real estate market? Build more homes!

Then there’s this tweet from Mark Cuban, who absolutely should know better:

It is true that the seller won’t know which buyers have the $25,000 credit and which don’t. The problem is that the information isn’t relevant. Giving millions of people $25,000 to buy a home will lead to bidding wars on some homes between buyers that have the additional available cash. That will result in home prices going up. Future home sellers will notice, and will likewise increase their asking price when they put the home on the market. Again, think what would happen if the government randomly gave 10 million families $1 million each to spend on a home. People selling homes would not know if a prospective buyer was one of those 10 million families. But when two perspective buyers are suddenly willing to pay way over-market for the same house, it raises prices.

Housing is unaffordable in America. It’s a massive problem - I would say arguably the country’s biggest. There is one way to fix it, and one way only. Build housing. Build single-family homes where there are no homes. Build row houses where there are single-family homes. Build high-rises where there are row houses. Build housing everywhere we can. Crater the market. Make homeowners like myself, who bought a house in 2022, eternally frustrated that our homes aren’t gaining value. Build, build, build, until the median price of a home in every county is less than three times the median salary.

It’s the only way.