Is 2024 the best economy of the 21st century?

Arguably.

Two of my favorite writers, Nate Silver and Noah Smith, agree on most things. They are both level-headed, data-driven individuals who are capable of thinking for themselves and plotting their own course. For once, however, they have diverged.

It started when Noah Smith wrote a post about how remarkable the US economy currently is. Others repeated the narrative, and Nate Silver responded with this:

Noah Smith then wrote a follow-up post on his Substack, further defending that 2024 is the best economy the US has seen in decades. A relatively polite Twitter feud involving Silver and several others followed. So which is it? Is 2024 just an average year or is it the best in decades? I’m going to chart a middle course. 2024 is certainly an above average year, but it is not the best year in decades. In fact, it isn’t the best year in a decade. That honor goes to 2019.

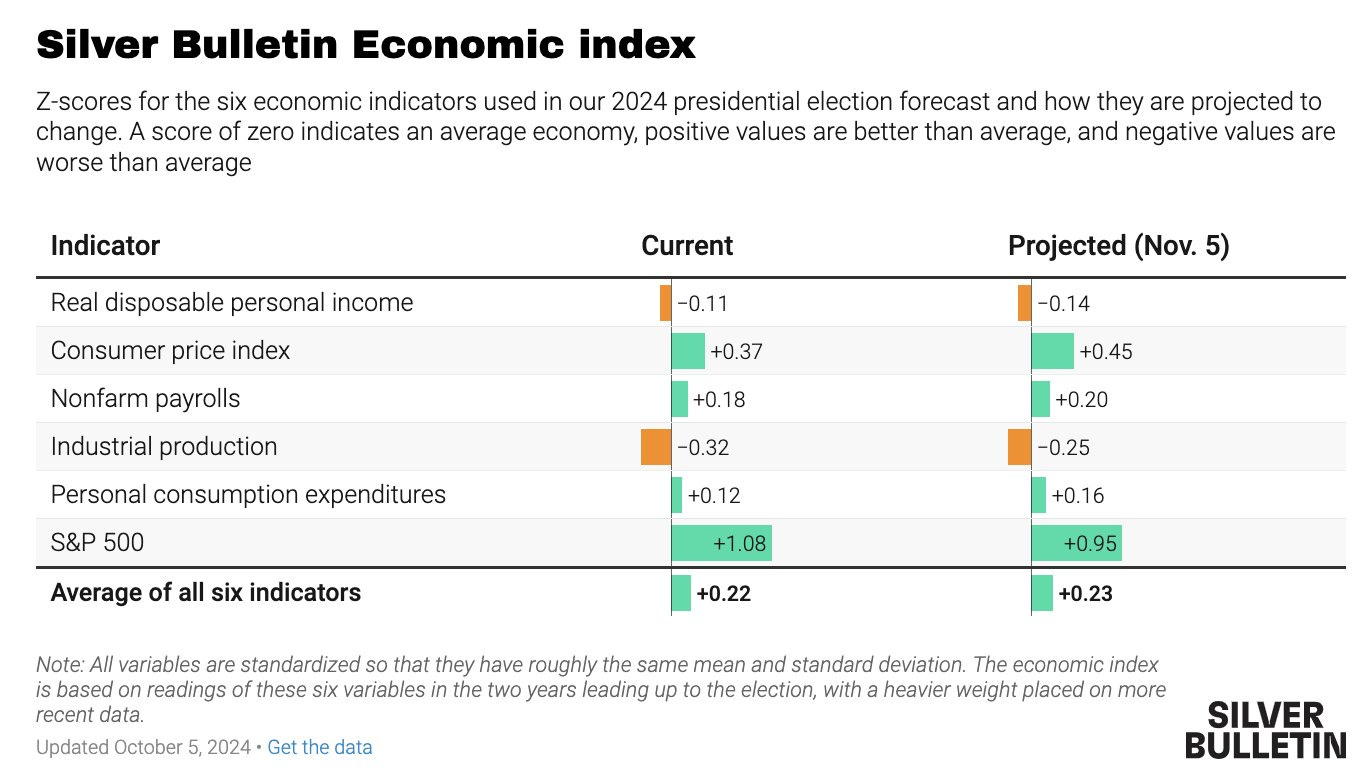

My one firm disagreement is that Nate Silver is wrong to say that a claim that 2024 is the best economy in decades is “straight-up misinformation”. Coming from someone who has battled the term and use of misinformation for years, it surprised me to see Silver carelessly throw it around. Nate does support his view that the 2024 economy is merely average, using this index:

Fair enough. But Noah Smith also uses data that points towards 2024 being a bumper year. It’s reasonable for smart, well-informed people to disagree on what “best economy” means. Calling out a differing view about the best anything, from the economy to breakfast cereal as misinformation is risky. Obviously the best breakfast cereal is Honey Bunches of Oates, but I wouldn’t say the Philistines who claim Cinnamon Toast Crunch as the best cereal to be propagating misinformation. They just have the palate of a kindergartner.

What is the case for 2024 being the best economy in decades? Noah Smith lists four attributes:

Essentially, there are four things you want from a macroeconomy:

You want high employment rates, so that everyone who wants a job has a job.

You want low and stable inflation rates, so that people know how much a dollar will be worth a month from now.

You want fast wage growth, so that regular working people are taking home their share of economic growth.

And you want fast productivity growth, because ultimately that’s what creates durable gains in living standards.

Right now, the U.S. economy is giving us all of those things.

From this perspective, yes, 2024 is one of the best years in decades. It’s worth mentioning just how strong the labor market is right now. Noah Smith likes to use prime-age employment-population ratio over the unemployment rate. This makes sense. The unemployment rate has a big weakness - if someone isn’t looking for work, they are unemployed. During the early 2010s, this artificially deflated the unemployment rate. From November 2010 to November 2013, the unemployment rate decreased from 9.8 to 6.9 percent, a change of almost three percentage points. A lot of that decrease, however, was because of discouraged workers who stopped looking for a job after years of failed searches. They were unemployed and wanted to be working, but because they weren’t actively looking for work they didn’t count as unemployed.

The issue I have with Noah Smith’s approach is that he uses prime-age employment-population ratio, that is, the percentage of people 25-54 years old who are working. Looking at the chart, you can see that 2024 is a bumper year, slightly higher than 2019:

But I don’t think prime-age employment-population ratio is the best way to measure the health of the economy. Instead, the employment-population ratio, full-stop, is better. That is the measure that includes all people, not only those of prime working age. According to that metric, 2019 is slightly better than 2024:

Some would likely say that using the full employment-population ratio is misleading because America is aging, so it would be expected to be lower because a lower percent of the population is of working age. I agree with that as a fact, but disagree that an economy should be graded on a curve. Yes, economies that have a higher portion of retirees will have a lower employment-population ratio, all else equal. That doesn’t mean we should pretend those retirees don’t exist. One of the reasons Japan’s economy is weaker today than in the 1980s is because its population is older. Fine. That’s a reason for a weakening, not a reason to ignore the fact that the vast number of retirees are hurting Japan’s economy. That’s like saying Chicago has a more diverse restaurant scene than St. Louis, but only because it has more people. It’s true that having more people makes it easier to have more diverse restaurants, but it doesn’t change the fact that Chicago still has the more diverse dining. A lot of elderly Americans left the workforce because of Covid, and some of them remained out of the workforce. Those individuals still take Social Security and Medicare and use resources. They shouldn’t be ignored.

Crucially, regardless of whether one is considering the prime-age employment-population ratio or the full employment-population ratio, the numbers are pretty close in both 2019 and 2024. When you look at other statistics Smith is focusing on, you see similar outcomes. Labor productivity is about the same, as is real GDP per capita. Anyway you dice it, 2019 and 2024 are fairly similar.

There are two main reasons I think 2019 edges out 2024. First is the deficit. The economy in 2024 might be doing similar to 2019, but the entire gap can be plausibly attributed to the government spending money it doesn’t have. The deficit-to-GDP ratio is expected to hit a whopping 7.0 percent of GDP in 2024. These are numbers that have only been reached during WWII, the Great Recession, and during Covid. That is not a good look. To be fair, the deficit was 4.6 percent of GDP in 2019, which is also far too high. Seven percent is ludicrous. I suppose one can argue that even if the growth today is coming at the expense of borrowed money that will be a drag on growth tomorrow, that growth today is still happening, but that rings false to me.

Second, the biggest difference between 2019 and 2024 is inflation. Ironically, Noah Smith is making the same type of mistake many partisan hacks have made over the last year. I constantly see people railing that government numbers must be fake because the government keeps saying inflation has fallen but prices are still high. This is not a contradictory statement. Inflation refers to the change in prices, so if prices have leveled off it means inflation isn’t happening. Prices rarely fall after bouts of inflation. We don’t want them to, as that would signal a host of other issues. People don’t understand what inflation is and draw the wrong conclusions.

Smith is making a similar mistake by saying that since inflation has come down, high prices are no longer a problem. He knows what inflation is, but is incorrectly assuming that low inflation today means high prices aren’t an issue. The fact is that the official inflation numbers have come down because inflation is given over a one-year window. If prices are the same today as they were in September 2023, inflation is zero. But that’s an arbitrary convention. Prices may have leveled off over the last year, but people don’t think in one-year increments. If prices were to double from 2025 to 2026, and then increase by 2.0 percent from 2026 to 2027, then yes, inflation has been “beaten” by 2027. But consumers would be outraged. Prices would have more than doubled over the last two years!

In the real world, prices (fortunately) didn’t double between 2021 and 2024. They went up by around a sixth. That’s still a big change. In 2019, inflation was low, and it had been low for 30 years. Today, inflation has come down, but people are still grappling with the changes. I, for one, am still not used to paying $8 for a beer at a brewery. It stings. I’m sure many other people feel the same way. So while inflation appears to have been beaten, consumers are still feeling the headache of the price increases incurred over the last 3+ years.

In a similar vein, Smith says that the increase in housing prices is a reflection of the increases in wealth and shows the economy is strong. I disagree. At current levels, house prices are the result of an insane combination of loose money and restrictive zoning measures that are serving to make the rich richer and the poor poorer. The US economy would be fundamentally stronger if house prices decreased.

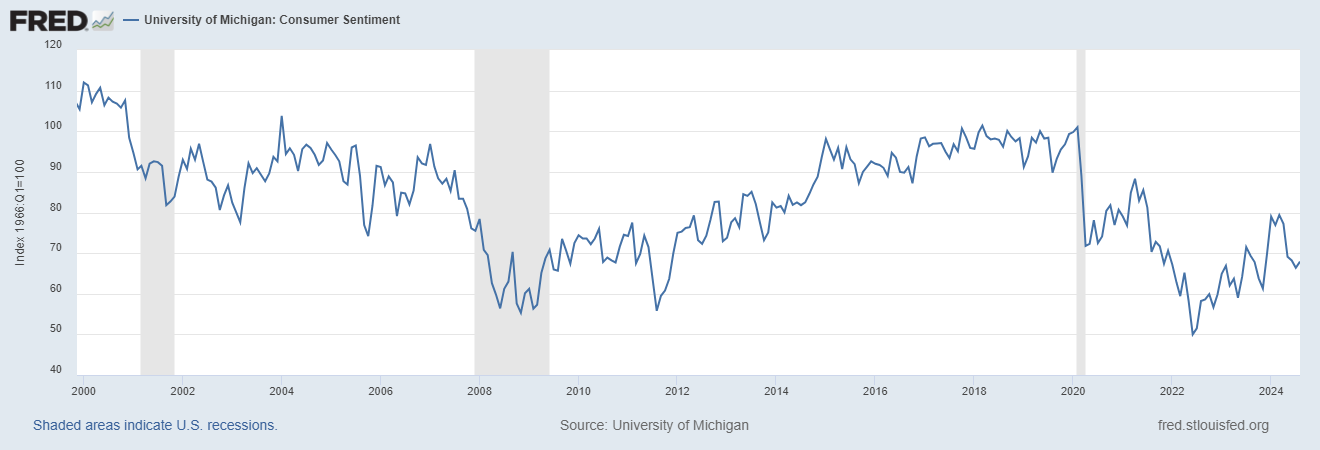

Finally, what makes the “best” economy also needs to include what consumers think. For that it’s a no-brainer. Consumers felt way better about the economy in 2019 than they feel today:

Nate Silver is wrong to say it’s misinformation to declare 2024 the best year in recent decades. It’s also a stretch to say it was the best year in decades. Looking back through the data, 2005 seems like better than either 2019 or 2024. Regardless, the 2024 economy is in good shape. I just wish someone other than me was enjoying it.