Over the last few months, protests have occurred across France (the media hivemind has decided the operative adjective is "roiled"). The cause of their consternation? The government has decided to raise the retirement age from, wait for it, 62 to 64 years old. Sacré bleu! Jokes aside, this issue is important. Not just for the French, but for Americans as well.

The French retirement age has long been a topic of controversy. Unlike America, however, where Social Security is often called the "third rail" of politics, French politicians will often tinker with retirement benefits, and in recent years proposals have centered around making retirement benefits less generous, not more. Of course it is easy to snicker about the French complaining about a tightening of the pension system. In the 1980s, President Francois Mitterrand lowered the retirement age from 65 to 60, one of the lowest retirement ages in the world. In 2000, the government made the legal work week 35 hours. The typical French worker can expect 30 days of paid vacation.

But all these rules have not been good for the French economy. French GDP per capita was higher in 2008 than today. The unemployment rate has been above 7% since 1980. It is so difficult to fire workers in France that employers are hesitant to employ anyone full-time. The French unemployment rate for 15-24-year-olds is a sky-high 19%. Combining a generous welfare state with rules that severely restrict the labor market is not a good combination. It is clear that something has to give, and the President of France, Emmanual Macron, decided to take the risky gambit of raising the retirement age from 62 to 64.

The economics here makes sense. The French use a "pay-as-you-go" system, which means that money contributed by workers today is spent on retirees today. This makes managing the system easier but also means that no money from workers today is saved for their own retirement. Instead, workers today support retirees today, with the understanding that workers tomorrow will support them when they retire. In order for such a system to work, however, there need to be enough workers to support the non-workers. This is France's problem. In 2000 there were 2.1 workers for every retiree. Today, there are 1.7. By the year 2070, there will only be 1.2. The system cannot support such bad ratios.

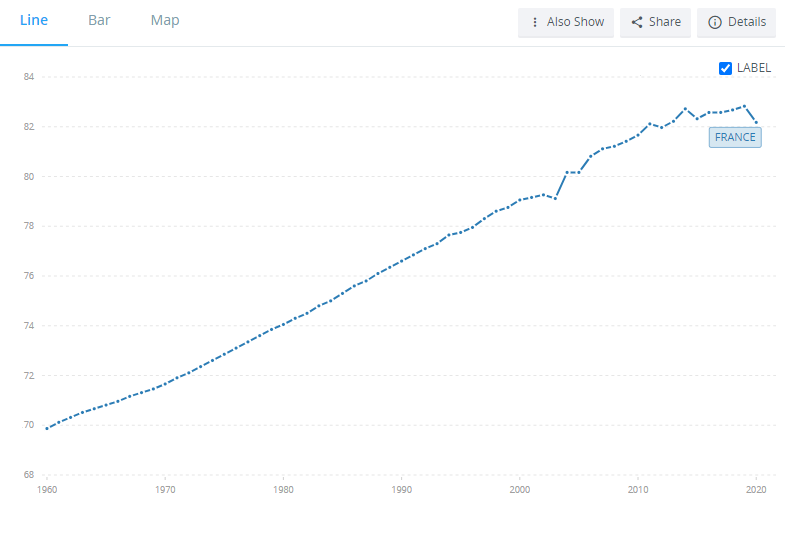

The main cause of this is a good thing - increase life expectancy. Look at the graph below that shows French life expectancy:

When the retirement age was lowered to 60, the average life expectancy was 74. Today it is 82. That means eight additional years of workers taking care of retirees. The system was built to have around three workers paying for one retiree; there is no way that it can survive a near 1:1 ratio.

Of course, economic sense and political sense are two different things. The French love to strike, and they are good at it. Public transportation is often stopped for days at a time (the media hivemind adjective here is "crippled"). Garbage collection will stop for weeks. Cars will burn. Financial offices will be occupied. During previous attempts to raise the retirement age, these strikes were often successful. This time around, however, President Macron seems to have succeeded.

He succeeded through some parliamentary maneuvering that greatly added to the ire of the protesters. France, like many other countries, has a bicameral legislature, meaning there are two different houses. For a bill to become a law, it generally has to pass both houses. Macron's bill passed through the upper house, the Senate, but appeared likely to fail in the lower house, the National Assembly. Fortunately for him, the French Constitution allows the president to avoid a vote in the lower house under certain circumstances. This article, 49.3 for those keeping track, has been used around 100 times over the last 60 years. Because of the undemocratic nature of allowing a bill to become law without passing the lower house, if Article 49.3 is invoked, the National Assembly can hold a vote of no-confidence in the government, which would likely stop the law from being enacted. This did happen, but the vote fell short by a wafer-thin margin of nine votes. The bill has now passed through the constitutional council and was enacted last month.

Side note: It's nice to see France have to deal with some of the same political hypocrisy as America, in a sour-grapes kind of way. The Republican party (of France) proposed this same retirement increase as Macron when they were in power. It failed to ever pass, however. This time around, as they are not in power, they refused to support the bill. Sound familiar?

So why does this matter for America? Because we are facing the same set of problems. When Social Security began in 1935, 65 was chosen as the retirement age because that was roughly the American life expectancy! Retirement wasn't meant to be a time period of life akin to childhood, it was meant to be only for those that live longer than average. As America aged, that means the system had to evolve and find larger sources of revenue. However, those changes have stopped. Americans are continuing to age, but no new resources are coming in. Thus, the Social Security Administration today predicts that there will be a shortage of funds in 2037.

So something has to give. Either we make Social Security benefits less generous or we increase taxes. There's no other way around it. So while Macron's plan is controversial, he at least recognized the problem and took steps to deal with it before it was too late. The French pension program is currently solvent, the same as the US's. However, Macron recognized that this is not the type of problem to ignore until the last minute, and he stuck to his convictions before it was too late.

From an economically liberal standpoint, your conclusion doesn't seem justified. A third option – the one occurring as we speak – is the importation of millions of young workers ("lumps of labor" in your terms) in order to prop up the tottering system. I say "from an economically liberal standpoint" because it would seem that "growth" would be a canonical way out of the predicament. Also, average male life expectancy in the U.S. is about 73 for men, and it is declining.

Otto Von Bismarck strikes again. He invented this idea of "retirement," paying old people (over 70) to leave the economy so young people could work instead.